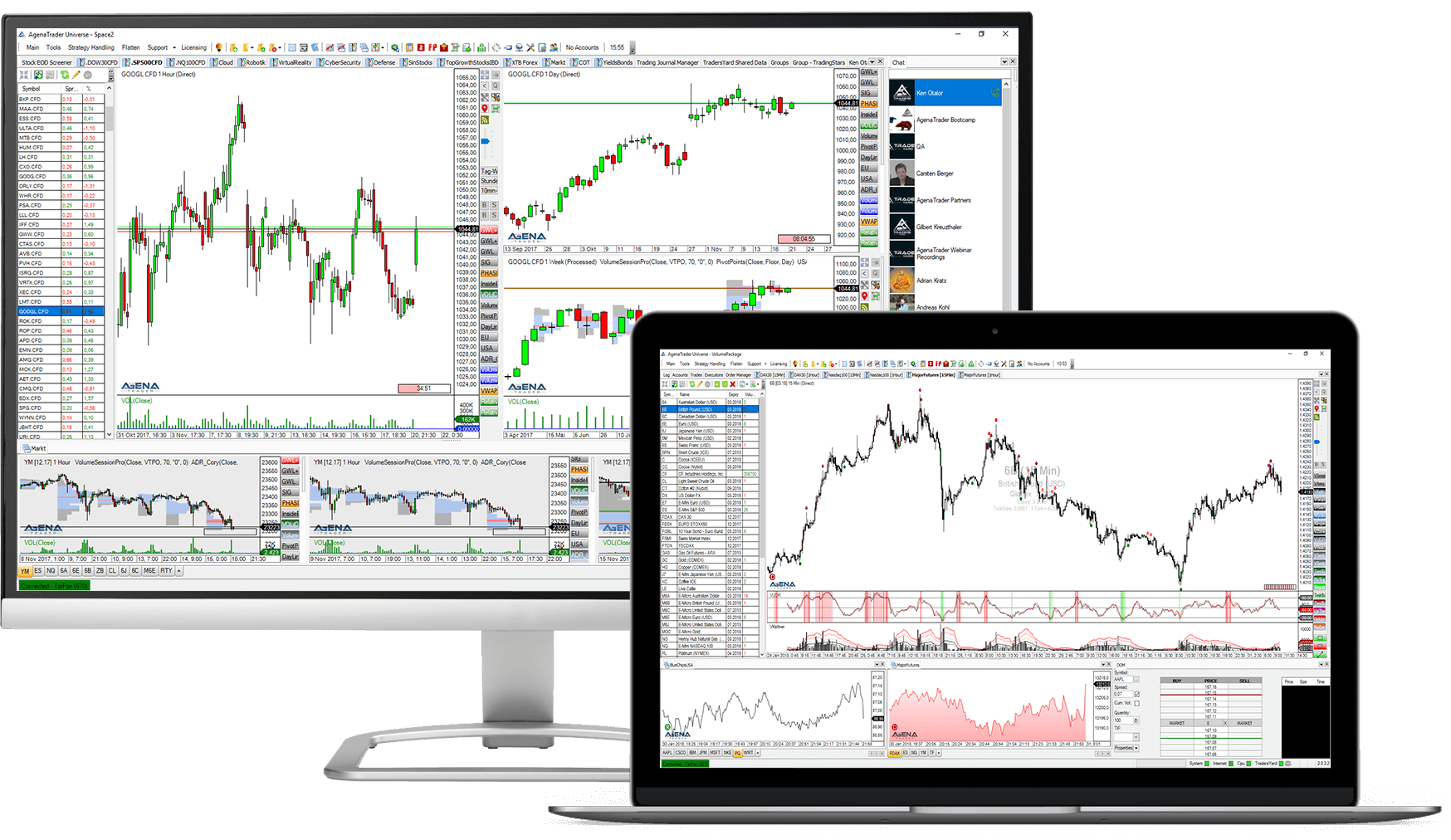

Volume Trading Software

Volume Trading AddOn is comprised of 12 Indicators and 8 Conditions (Signals)

All indicators are fine tuned to minimize compute time as price and volume flow in real-time.

Volume Session Pro is the cornerstone of our Volume Analysis AddOn, and empowers professional traders to identify when the market is being accumulated, distributed, or if there is no demand. With this AddOn, you will gain the edge you’ve been looking for.

![]()

Volume Trading AddOn

The Volume Trading Software AddOn comes with an extensive collection of indicators that will help you with volume analysis trading.

Volume Session Pro

This indicator is equivalent to the well-known VolumeProfile indicator with a display for a specific time span (session). You can determine the start time and the length of a session however you wish.

Volume Area

Similarly, with this indicator you can also have your own volume profiles displayed. Here you can now determine the start and end time completely freely by clicking on your desired position

Klinger Volume Oscillator

The KlingerVolumeOscillator is a technical indicator that was developed by Stephen Klinger in order to determine long-term trends of the money flow. At the same time, the indicator is sensitive enough to also identify short-term fluctuations

Volume Keltner Channels

.Volume that is higher than the highest Keltner channel line can be interpreted as extremely high volume that shows that huge numbers of trades. The VolumeKeltnerChannels are a great tool to determine very high or very low volume in comparison to past periods

Volume UDR

The VolumeUpDownRatio is the relationship between UpVolume and DownVolume, displayed as an oscillator.

Volume Tick Speed

The indicator measures the number of ticks that are traded during a number of seconds defined by the user.

Volume Zone Oscillator

The VolumeZoneOscillator divides the volume activity into UpVolume and DownVolume, similarly to the VolumeUDR.

Volume Rise Fall

The VolumeRiseFall indicator is a normal volume display as volume bars, with, however, a different coloring than normal.

Wyckoff Wave

The WyckoffWave indicator adds the volume for each following bar until a price wave is over / finished. You can set the sensitivity of the price waves. When the volume of a wave rises to particularly high values, is it very often because a turning point in the chart has been reached

Volume Graph

This indicator contains a normal volume histogram, but here, the coloring takes place based on price trends. The VolumeGraph determines short- or long-term price trends

Volume Sentiment Long

This indicator detects bullish volume activity based on the analysis of the volume of a period, the price span of a bar and the close of the bar (=VolumeSpreadAnalysis).

Volume Sentiment Short

This indicator is the counterpart to the VolumeSentimentLong and detects bearish volume activity based on the analysis of the volume of a period, the price span of a bar and the close of the bar (=VolumeSpreadAnalysis)

Conditions

Volume signals should generally not be traded with market orders immediately, but instead one should wait for a confirmation of the signal with stop orders at the high or low of the signal candle. Below you can find the conditions which are comming with the Volume Trading AddOn

- Long No Supply

- Long Stopping Volume

- Long Testbar

- Long TwoBar Reversal

- Short Up-Thrust

- Short Hidden Up-Thrust

- Short No Demand

- Short TwoBar Reversal

Find the full documentation of the Volume AddOn HERE