Effects of Advanced Platform Technologies on Trading Performance

The Gap Between Skill and Technology

There are numerous factors to take into account when assessing trading performance. Factors such as market knowledge, trading technique, experience level, and mental/psychological response are recognized, particularly among non-professional (or “retail”) traders, as general attributes defining market performances. It’s easy for most traders to focus on these factors–extrinsic in origin, they are internalized over time, transformed into a second-nature response.

Standing apart from these habitualized factors is yet another critical element whose impact on performance is equally significant, though much less recognized in non-professional circles: platform technology. Although trading platforms have always been considered an important trading component–as it is the only thing providing live market access and trade execution–its importance as a “smart” tool with internalized assist-functions have neither been fully recognized nor explored. The notion surrounding the trading platforms has remained one of a “passive” tool dependent on user manipulation, in stark contrast to an “active” or potentially “smart” technology.

As a result, when retail traders assess trading performance, the majority tends to focus disproportionately on internal traits–as evidenced by all of the trading education services and publications available–rather than technological advantages.

In contrast to institutional trading firms, whose integrative technological R&D efforts are incessant, retail traders are often left in the dust, unaware that the “edge” they seek is, in actuality, a “technologized” advantage.

A “Smarter” Solution for Optimizing Performance and Skills

The Agena Trader platform was designed to target this gap between skills and technology. A key feature of the platform–“semi-automation” — provides optimized trade-assist functions that operate at the “smart technology” level, lacking only AI machine-learning capabilities that characterize completely-autonomous smart machines.

Nevertheless, as a smart device, Agena Trader (AT) shoulders a large portion of a trader’s load with regard to market intelligence, probability analysis, trade selection across multiple markets, risk management, and loss prevention when a trader’s individual parameters are violated by the trader him/herself.

These tasks amount to an optimized form of trade assistance but it takes place at a fraction of the speed of human decision-making in addition to operating across multiple markets simultaneously. Far from a “passive” machine requiring constant monitoring and input, Agena Trader’s smart functions can be embedded into the very fabric of a trader’s decision and execution processes–an integration that can often protect traders from their own actions, allowing them not only to prevent errors and losses, but also to enhance their own skills and trading performance.

Measuring the Effect of Agena Trader’s Technology on Trading Performance

To assess the effect of the Agena Trader platform on trading performance, we conducted two random client surveys. In summary almost 500 traders agreed to participate in the two studies. Here are the results of the assessment:

TRADER PROFILES

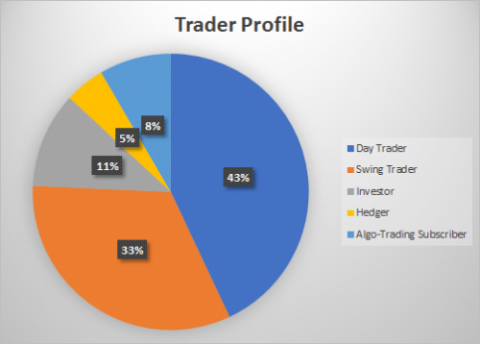

The survey participants identified themselves according to the following categories:

- Day Traders – 43%

- Swing Traders – 33%

- Investors – 11%

- Hedgers – 8%

- Algo-Trading Subscribers – 5%

92% of the participants identified themselves as independent retail traders.

TRADING EXPERIENCE

The largest group of participants — 65% — had 7 or more years of experience in live trading, while 35% had from zero to six years of trading experience.

- 0 – 3 years: 9%

- 4 – 6 years: 26%

- 7 – 10 years: 35%

- 10+ years: 30%

MARKETS TRADED

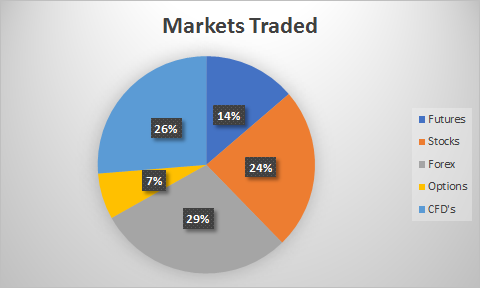

Among the markets traded, the largest group traded forex (29%), second largest traded CFD’s (26%), third largest traded stocks (24%), fourth largest traded futures (14%), and the fifth largest group traded options (7%).

EFFECT OF AGENATRADER PLATFORM ON PROFITABILITY

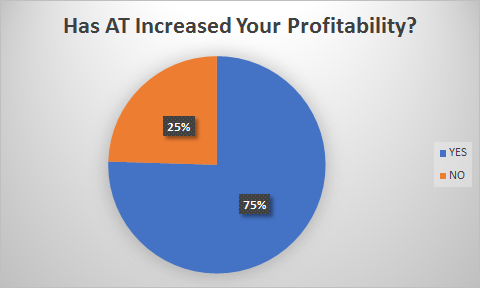

When asked about AT’s effect on trading profitability, 75% of the traders responded with a resounding “Yes.”

What’s notable about this response is that the 75% who found AT to affect profitability were on the higher scale of market experience. The 25% who experienced no increase in trading profitability were those who had less experience in actual trading.

In addition to this, 75% of the “experienced” traders also had more experience trading different platforms in live markets, making such an assessment implicitly comparative with regard to other existing platforms.

EFFECT OF AGENATRADER PLATFORM ON EFFICACY

Profitability is subject to a host of variables, from a trader’s choice of markets, to strategy, capital resources, goals, and timing. However, a precondition to a trader’s profitability is the capacity to operate with efficiency and efficacy, free of restrictions that impede strategy implementation. This latter aspect is what a platform can reasonably guarantee. Although market dynamics are in constant flux, the means to effectively engage markets are relatively fixed.

It is toward this end–enabling traders to be more efficient and effective–that Agena Trader excels. And 90% of the survey participants found Agena Trader helpful in achieving high levels of performance and in increasing the effectiveness. (Time saving, error avoidance, …)

Top 5 Rated Functionalities

Among 15 existing functionalities offered by the Agena Trader platform, the following top five were considered most useful by traders in the survey:

- Risk and Money Management Features: 88% of the participants found that the platform was effective in reducing overall risk in their live trading.

- Setup Escort: 81% found the trade setup functionalities beneficial to identifying and executing trades.

- Condition Escort: 75% found the condition escort easy to use when setting up their own individual trade parameters.

- Real time signals scanner: 70% agreed that the platform accurately identified and measured high-probability trades from which the participants were able to select and execute.

- One-Click Trading: 63% defined this feature as important and experienced benefits in their trade execution.

The benefits that most of the participants found useful were those geared toward risk management, semi-automated trade setups-identification, analysis, probability assessments and trade planning from both fundamental and technical perspectives.

Conclusion:

Participants considered Agena Trader’s smart tool functionalities to be the most significant aspects of the platform as compared with other existing features such as DOM, charting, programming interface, and portfolio backtesting. The platform’s proactive and responsive trade-assist features, all of which allow the participants to operate in an efficient and seamless manner, are what seem to enhance a trader’s performance, optimizing their chances for increased profitability.

As for Agena Trader users, the additional stats summarize the platform’s overall effect on user experience–an effect that goes well beyond ease and efficiency and toward competitive advantage.

- 88% consider Agena Trader to be far superior to other competing platforms.

- 85% are completely satisfied with its features and would recommend it to other traders who are serious about gaining a technological edge in the markets.

- And 35% of our most experienced traders mentioned that without Agena Trader, they would consider leaving the markets, as other platforms would severely downgrade their capabilities and market competitiveness.

By targeting the gap between skills and technology through smart technology, Agena Trader creates an enhanced level of trading performance where human skill and technology combine in a seamless and mutually reinforcing manner.

Leave A Comment

You must be logged in to post a comment.