Find High-Probability Trades with Trend Combinations

When you look at a chart you can often see different trends flowing into each other. A clever combination of these trends will provide clear insights into trading opportunities, as if the market itself came knocking upon your door. You just need the patience to wait for the right moment, like a hunter waiting for the right moment to shoot his prey.

How to see the right moment

If you can discern the intentions of the other trend trading actors you can read the marks they left on the chart. You get a pretty clear picture of price marks where for example:

- Trends continue or break and trend traders become active

- Where a progression finishes and regression traders start opening positions

- When the regression ends and trend traders once again place orders

Combination of trends

The existence of a multiple-trend chart depends on the market liquidity. Basically, you can assume that highly liquid assets create more different trends than assets with lower liquidity. The higher the liquidity the larger the presence of different trends appearing in charts of the selected timeframe. Usually there are up to four trend sizes to see:

- Large trend

- Medium trend

- Small trend

- Smallest trend

Pay attention to the combination of the different trend sizes. Practice has been proven that you can trade the individual parts of a trend, namely its progression and regression. Furthermore, practice has shown that you can trade out of a trend’s correction by using the following combinations:

- Large trend vs. medium trend

- Medium trend vs. small trend

- Small trend vs. smallest trend

The larger trend is always superior and therefore provides direction. You use the minor trend to trade into the superior.

There is one thing in the context of trend combination that you should absolutely consider: A signal resulting from two converging trends work respectably when two direct continuous trends are in combination.

Failed trades are often based on a misinterpretation of different visible trend-sizes.

Here is an example:

You use the medium trend to set your superior trading direction. Within it you can view the progression and regression arms created by the small trend.

When the small regression trend is broken and a new progression trend has formed, the cards are good for the start of a new movement toward the superior trend.

But if you use the “smallest” trend in combination with the medium you will jump the small (minor) trend. If the minor trend is still running against the superior trend and you trade the smallest trend into the medium, you end up catching a falling knife.

If you are looking for low-risk trades using trend combinations, never trade against the superior trend. That will only boost your risk and increase the chances for a missed trade.

Setup for new trends – trend break by a movement

An existing trend is violated by a price movement that is more or less trendless. After the trend break, wait for a counter movement followed by a third movement into the direction of the original trend. At the price level where the new trend will be formed can you open your first position. Work with a Stop-(Limit*)-Order to make sure that you open your position only if the trend is existent.

*Use the additional price limit to make sure that you pay not more (long) or get not less (short) as you want for your position opening.

For the case that the prior trend break happened trough an existing trend, use the following setup for trading an existing trend out of the correction.

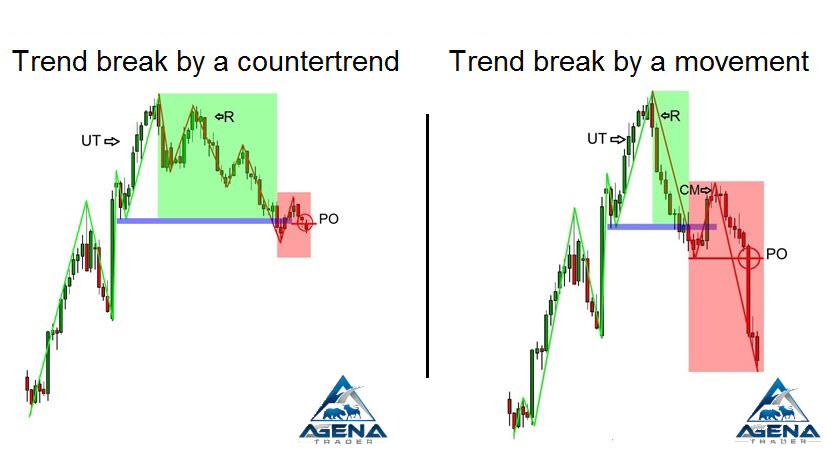

Image 1:

At the left hand side do you see an uptrend (UT) followed by a regression(R). The regressive price movements formed what appears as a counter trend–a sub-trend with its own smaller movements and regressions. In the red box, you will notice that the downward trend establishes a set-up(PO): a price level that, if violated, confirms a short trade.

The right-hand side of this picture display the actual violation of this (UT) price level. The position opening (PO) occurs in that case with the formation of the new trend after a counter movement (CM) in the red box.

Entry into a running trend – trend break by a countertrend

Here we find an already existing trend. As a trend trader you can decide to trade the trend or just its progression component (also called movement). No matter what you trade, the entry strategy is the same for both. But there will be differences in setting the stop-loss and take-profit levels.

To enter a running trend, you are looking for a scenario in which the regression trend (a correction) has ended, such as in the case of a breakout. This is similar to finding a “new” trend within the larger movement. In other words, you simply trade the minor trend.

Primary position protection and stop trailing

To find the right protection level for your trade you should determine where the existing trend will get broken. You should identify the price level at which the trend will no longer be valid, hence marking the end of the trade. In short, a trend ends with a violation of the current P3.

So when you trade the superior trend, look for P3 level. If you are trading the minor trend, watch out for the minor P3 level area. The P3 area is where you will want to set your initial stop-loss.

If you are using a trailing stop, keep it simple by placing your stop at the correction lows in an uptrend and correction highs in a downtrend.

Always protect your trade with a stop-loss (which is, of course, a “stop” order).

Setting a target

When you trade the superior trend (that is, the longer primary trend), you will be working without a profit target. The reason for this is that you will not know beforehand where that final target will be. The same can be said if you are trading a minor that is in the same direction of the superior trend.

But if you are trading out of a deep correction, and if these is enough money to be earned in that trade, then you can set a profit target near the P2 of the superior trend.

Be sure to use Limit Orders for all your take-profit targets.

Trading a trend in combination with minor trends has a huge advantage. You find all the important information in one chart. And this helps you focus on profitable pivot situations within existing trends. You will not need additional indicators. By viewing the basic price action, you will be able to identify profit opportunities directly from the chart.

Please register to our free Webinar to learn about the Dow Theory in more detail.

Disclaimer:

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk.

Leave A Comment

You must be logged in to post a comment.