Jabil Inc. (JBL) Electronics manufacturer with a lot of downward potential

ISIN: US4663131039

Jabil Inc. is a leading contract manufacturer in the electronics industry. The company offers complete lifecycle solutions for products, starting with the design and the prototyping, to the production, all the way to the repair and warranty coverage. The corporation focuses in particular on the manufacture of circuit boards for OEMs in the sectors of entertainment electronics, aviation and defense, the automobile industry and more.

The following analysis will expand on the stock of the company from a chart-related point of view.

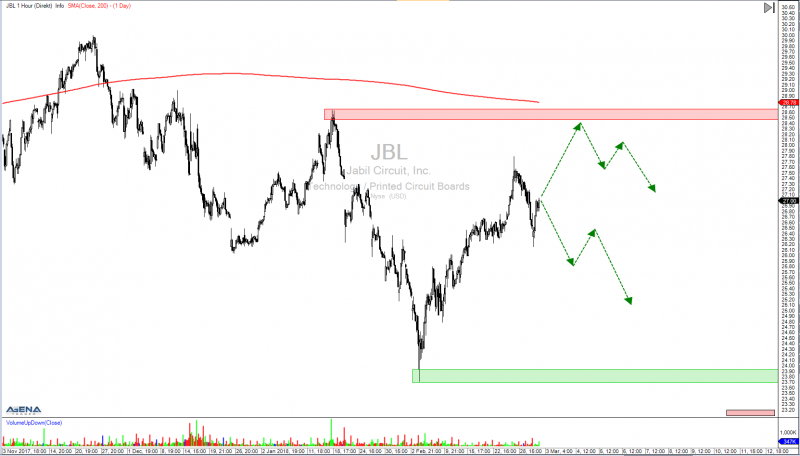

Review (daily chart)

After the price was unable to exceed the all-time high at approx. $31.50, the stock came under massive pressure. At the latest towards the end of last year, a confirmed downward trend was established, which was last reconfirmed in January. Most recently, the value found itself in a correction, and in the last trading week, took up increased movement in the trend direction once more. This indicates good chances for short entries with enormous downward potential down to the lows from 2016.

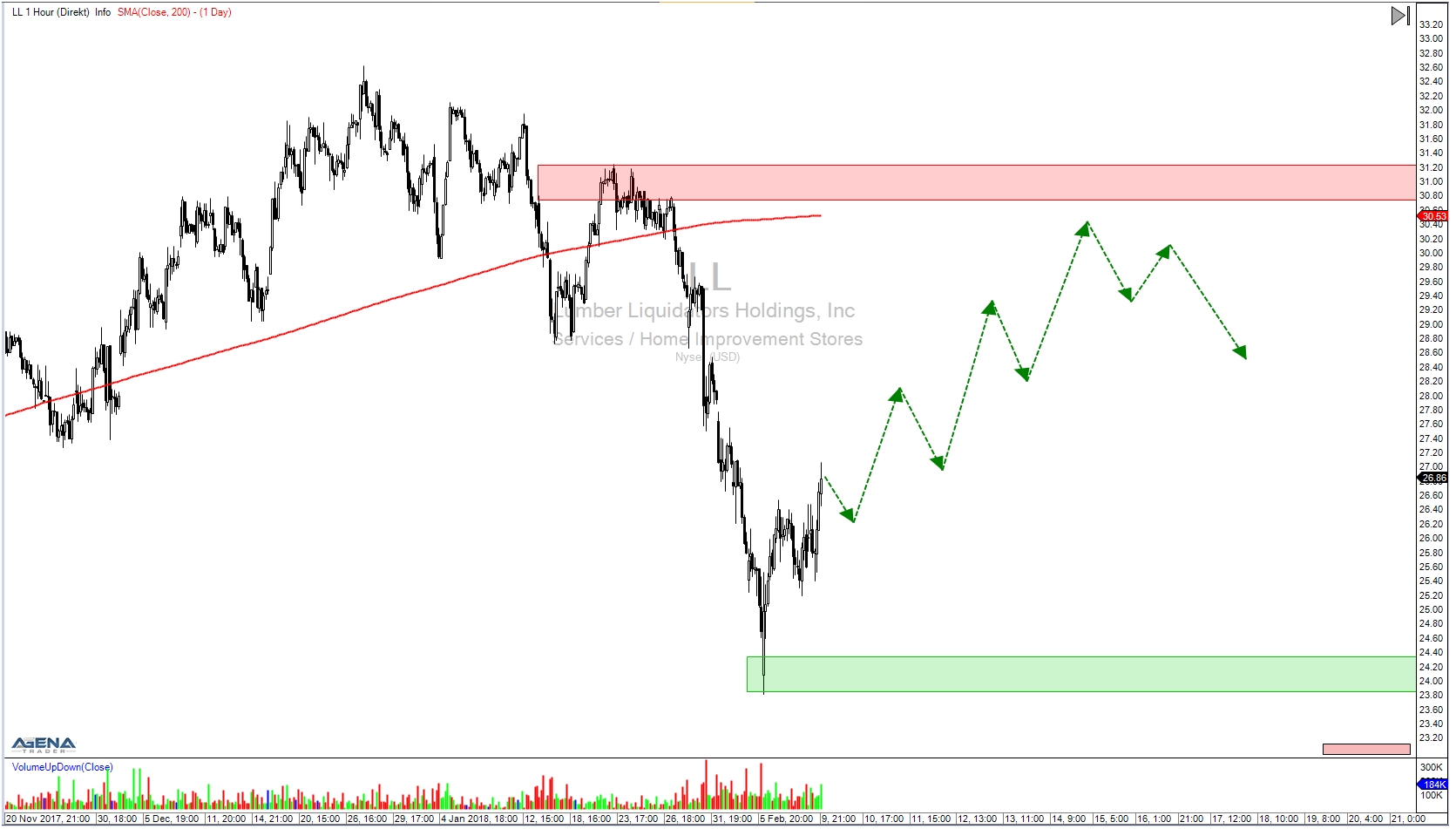

Outlook (hourly chart)

In the hourly chart, we can see the correction that is currently underway, which has yet to develop in our preferred trading direction.

For a short entry, one should wait for the formation of a signal, e.g. in the form of a P2, and place the stop loss above the last P3 (depicted in green).

Alternatively, and with the advantage of a cheaper stop, one can also practice trading from out of the correction or the formation of a reversal bar at a prominent point.

The first target is located in the area around $23.50 (see green zone in daily chart). A continuation of the trend to the next target at around $23.00 and even lower is definitely a possibility.

If the price clearly exceeds the last significant high at $28.65, the short scenario should be abandoned for the time being (see red zone in the daily chart).

Before trading, one should take news in the environment and from the company into account. Similarly, one should also observe the development of the overall market.

Disclosure of possible conflicts of interest: at the time of publishing this analysis, the author is not invested in the securities or underlyings discussed.

DISCLAIMER

Exchange transactions are associated with significant risks. Those who trade on the financial and commodity markets must familiarize themselves with these risks. Possible analyses, techniques and methods presented here are not an invitation to trade on the financial and commodity markets. They serve only for illustration, further education, and information purposes, and do not constitute investment advice or personal recommendations in any way. They are intended only to facilitate the customer’s investment decision, and do not replace the advice of an investor or specific investment advice. The customer trades completely at his or her own risk. It is expressly advised to observe our usage regulations and risk information, available under the link Legal Information on this internet page.

Leave A Comment

You must be logged in to post a comment.