Trend and momentum trading with the RimesRangeBarSniper Package

Picture 1: Blind men and an elephant

This is what traders look like thinking they know their indicator is the best.

Chart 1: The 10 range bar ES with the commodity channel index

ES 10 range bar with trades called using the RimesRangeBarSniper package, which utilizes the commodity channel index for part of trading logic. Notice trailing stop keeps the trader in the trade longer.

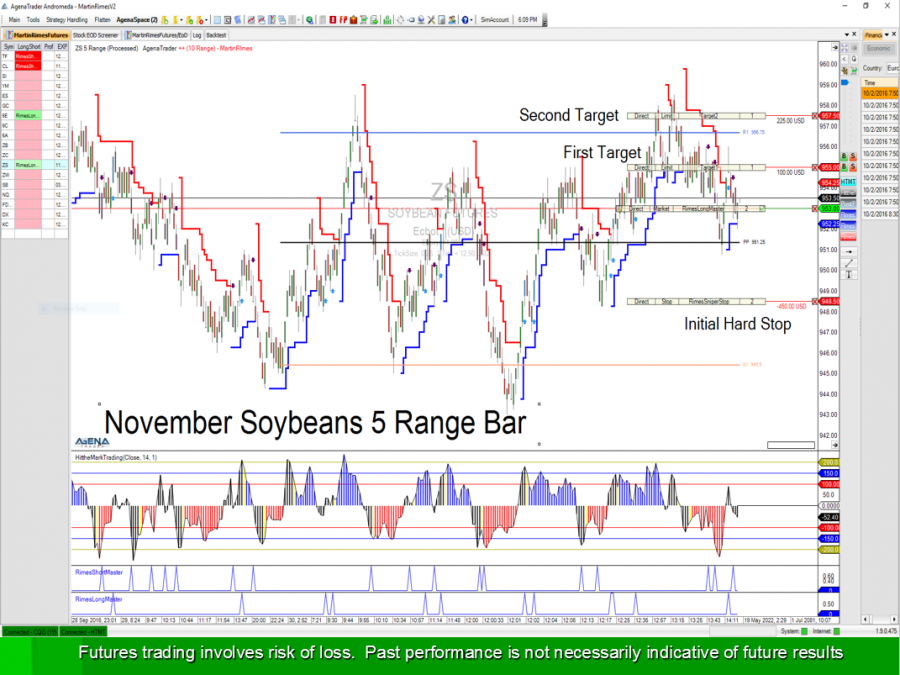

Chart 2: The 5 range bar Soybeans trade just after trade entry

November Soybeans trade entered using RimesRangeBarSniper package, which assigns suggested profit targets based on swing theory. Initial protective stop also generated.

Chart 3: Shows how the profit targets were generated off recent price swings

The package knows if price is simply trading in a range, lower the profit expectations.

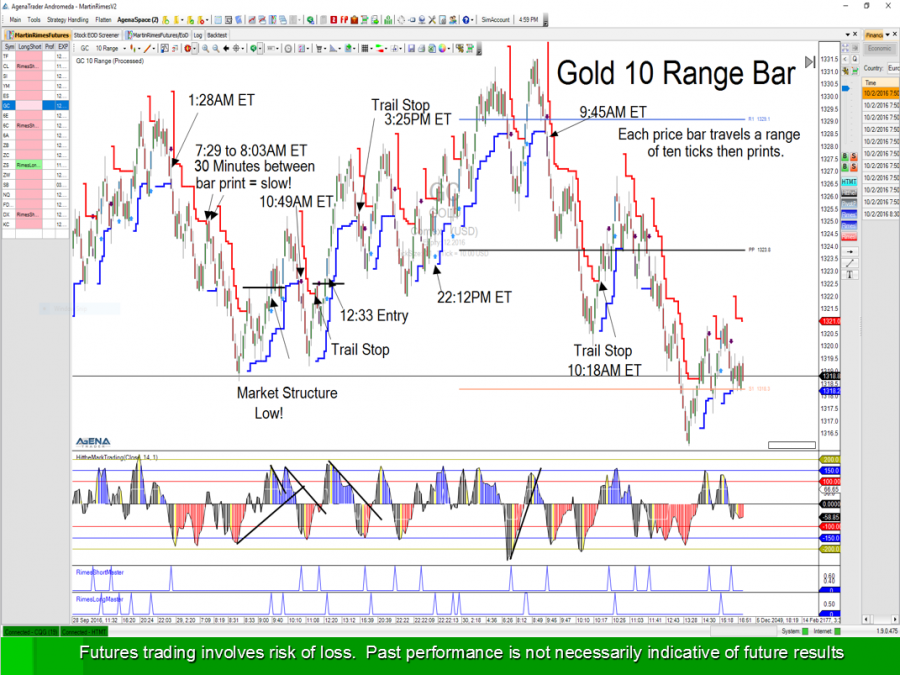

Chart 4: The 10 range bar gold chart

On this 10 range bar gold chart notice where price gets in and where trailing stop takes the trader out of the trade. Entry signals are shown on the chart and in a sub graph.

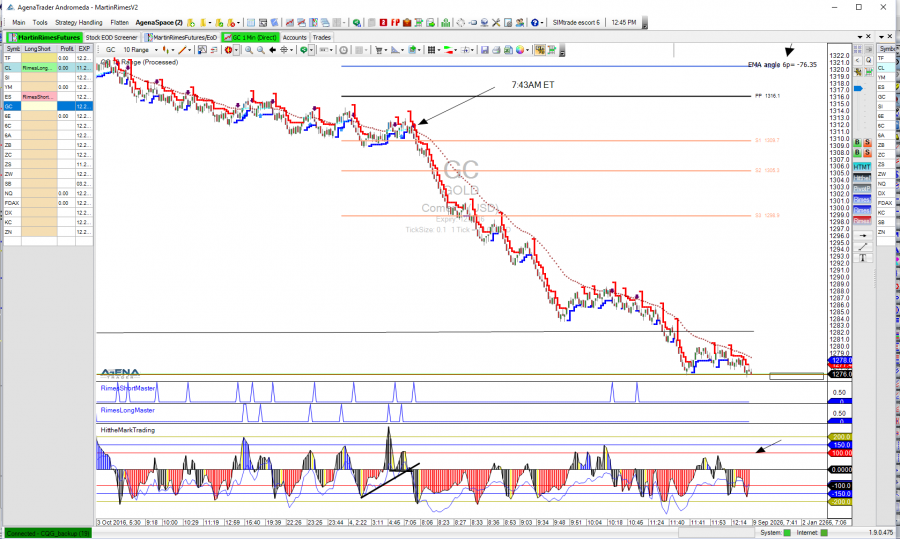

Sub-Chart 4.1: Gold chart from the 4th October 2016

IMPORTANT DISCLAIMER

RimesRangeBarSignal Package is part of Hit the Mark Trading, LLC, an educational service only and does not provide individual investment advice to subscribers. Please review your personal trading with a licensed financial advisor. The goal of Hit the Mark Trading, LLC is to educate and teach trading concepts. Employees and principals of Hit the Mark Trading, LLC, may or may not have positions in the suggested teaching trades. This newsletter is not intended to be used as a customized recommendation to buy, hold or sell securities, futures, or any financial instruments mentioned using real money. Only you and your licensed trading professional advisor should make recommendations for your trading account that involve the use of real money. Trading futures, stocks, bonds, options, and any financial instrument carry great risk and can result in the loss of any or all of trading capital. In your own trading with real money, under advice of a licensed professional, please only trade what you can truly afford to lose. Martin Rimes is not a CTA or licensed trading professional. Trading education, including programed software placing suggested trades on a price chart for demonstration of trading education is strictly the opinion of Martin Rimes and certainly not a recommendation for trading real money.

Trade signal suggestions from the RimesRangeBarSignal package are for teaching the concepts of trading, while in simulation, rather than placing real money at risk. Nothing is guaranteed from this service. You agree and understand the real time trade suggestions will show trades that are believed to show profitable follow through, but losses are inevitable too. You understand there are no guarantees your trading will have exact same results as shown on the RimesRangeBarSignal Package. You understand and agree market conditions change affecting day trading performance. Bottom line: The RimesRangeBarSignal Package is strictly a teaching tool designed to take the trading concepts into real time education action. If you decide on your own to copy the educational trades using real money, you are doing so at your own risk. You are the trader in command.

You agree to hold Martin Rimes and Hit the Mark Trading, LLC, harmless from any and all claims, liabilities, costs, and expenses associated in any way with the use of the RimesRangeBarSignal Package. You understand trading futures contracts and any financial instrument is risky. Please only trade with money you can afford to lose. Understand with futures, a trader can lose more than their account value due to the tremendous leverage offered with futures trading.

We adhere to the U.S. Government Disclaimer – Commodity Futures Trading Commission

Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Leave A Comment

You must be logged in to post a comment.